Contents:

Learn more about the benefits of dates for men here. A person should not eat dates that have a sour smell, are very hard, or have crystallized sugar on their surface. These signs can indicate the dates have gone bad. A person can store fresh dates in an airtight container in the refrigerator for many months and even longer in the freezer.

The value date is the same as the settlement date. A check is a written, dated, and signed instrument that contains an unconditional order directing a bank to pay a definite sum of money to a payee. A settlement date is defined as the date a trade is settled or as the payment date of benefits from a life insurance policy. For trading, the value date is the time at which a transaction is fully cleared and settled.

Excel dates

Deglet Noor dates are one of the most common types of dates that people can find in the supermarket. Dates can satisfy a person’s sweet tooth while also providing essential nutrients, such as vitamin B-6 and iron. In this tutorial, I showed you some great techniques to use the IF function with dates. I hope the tips covered here were useful for you.

If refrigerated, fortfs forex broker review dates will last for about 1 year in an airtight container and many years if frozen. Dates can be eaten fresh or dried, much like raisins. People can also add them to a variety of sweet or savory dishes. People can replace the sugar, chocolate chips, or candies in baking recipes with dates to ensure they are eating natural sugars instead of refined sugars.

Article Sources

In this example, the goal is to check if a given date is between two other dates, labeled “Start” and “End” in the example shown. For convenience, both start and end are named ranges. If you prefer not to use named ranges, make sure you use absolute references for E5 and E8. (Photo by-flickr.com-Itinerant)Date-Palm.Dates can be readily available in the groceries year-round.

Pershing Square Holdings, Ltd. Releases Regular Weekly Net Asset … – Business Wire

Pershing Square Holdings, Ltd. Releases Regular Weekly Net Asset ….

Posted: Wed, 08 Mar 2023 21:39:00 GMT [source]

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

How to Use IF Formula with Dates (6 Easy Examples)

One popular way to eat them is as a natural sweetener in various dishes. Although these potential health benefits are promising, more human studies are needed before conclusions can be made. Compared to similar types of fruit, such as figs and dried plums, dates appear to have the highest antioxidant content .

Vitamin-K is essential for many coagulant factors in the blood as well as in bone metabolism. Dates are an excellent sources of iron, carry 0.90 mg/100 g of fruits (about 11% of RDI). Iron, being a component of hemoglobin inside the red blood cells, determines the oxygen-carrying capacity of the blood. They compose antioxidant flavonoids such as ß-carotene, lutein, and zeaxanthin. These antioxidants found to have the ability to protect cells, and other structures in humans from the harmful effects of oxygen-free radicals.

- Please help improve this article by adding citations to reliable sources.

- Hopefully, the above examples will help you to understand the logic of the IF formula with dates.

- When shopping for dates, people should look for those that are shiny and unbroken.

Structured Query Language What is Structured Query Language ? Structured Query Language is a programming language used to interact with a database…. It is the legally binding date of an operational flow transaction and defines the start date for calculating accrual and deferral interest and other items.

In the U.S, the gender pay gap has hardly budged over the last 20 years. According to a recent Pew Center analysis, women overall still make an average of 82 percent of what men earn, up from just 80 percent in 2002. As creative a plan as this seemed to be, Howard-Gibbon said the ploy is a well known one within African American real estate circles.

Dates are high in potassium, which is an electrolyte the body needs for good heart health. Potassium also helps to build muscle and proteins in the body. Farmers harvest dates in the fall and early winter, so dates usually taste freshest at this time of year. However, many people eat dried dates, which can last for a long time in a sealed container. Dates—fruits of the date palm tree—have existed since prehistoric times and are believed to have been cultivated as early as 8,000 years ago. Native to the Middle East, there are over 100 different varieties of date palm trees.

Zelenska’s coalition building proved crucial to her country’s survival. Our videos are quick, clean, and to the point, so you can learn Excel in less time, and easily review key topics when needed. Each video comes with its own practice worksheet. I graduated with a bachelor’s degree in engineering. Currently, I am working as a technical content writer in ExcelDemy.

Date string formats are described in the next chapter. You will learn much more about how to display dates, later in this tutorial. Please help improve this article by adding citations to reliable sources.

thoughts on “Using IF Function with Dates in Excel (Easy Examples)”

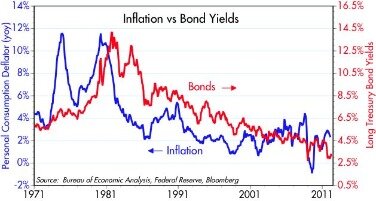

When there is a possibility for discrepancies due to differences in the timing of asset https://forexbitcoin.info/, the value date is used. Due to differences in time zones and bank processing delays, the value date for spot trades in foreign currencies is usually set two days after a transaction is agreed on. The value date is the day that the currencies are traded, not the date on which the traders agree to the exchange rate. When a payee presents a check to the bank, the bank credits the payee’s account. However, it could take days until the bank receives the funds from the payor’s bank, assuming the payor and payee have accounts with different financial institutions.

- Calculation of accrued interest takes into account three key dates—trade date, settlement date, and value date.

- The USDA provides the following nutrition information.

- If not, the formula returns an empty string (“”), which looks like an empty cell in Excel.

You can tell whether or not dates are dried based on their appearance. Wrinkled skin indicates they are dried, whereas smooth skin indicates freshness. Dates are the fruit of the date palm tree, which is grown in many tropical regions of the world. The value date is the date that the two currencies are traded and not the date of the agreement. Of course, the two business days do not include Saturdays, Sundays, or public holidays in either of the two countries of the currencies involved. However, the money’s not actually been received by the bank since they still need to collect the funds from the bank of the other party .

Content is reviewed before publication and upon substantial updates. Verywell Fit’s content is for informational and educational purposes only. Our website is not intended to be a substitute for professional medical advice, diagnosis, or treatment. Here are 16 tips to add more fiber to your diet to improve digestion, aid weight loss, and lower risk of diseases.

She is also the host of Good Food Friday on ABC News 4. Dates are incredibly versatile and make a delicious snack. They are often paired with other foods, such as almonds, nut butter, or soft cheese.